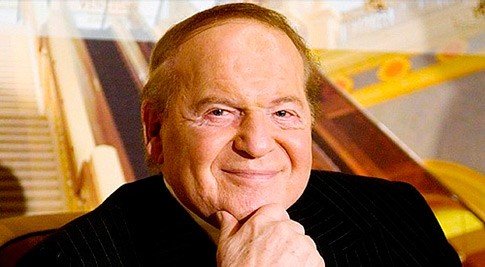

Sheldon Adelson calls Macau environment 'challenging'

Still, Las Vegas Sands benefited from a positive quarter in its other three markets, including the Strip and Singapore.

Las Vegas Sands said its profits for the quarter that ended Sept. 30 fell 22.7% to $519.4 million, which translated into earnings per share of 65 cents, a decline of 21.17%. Overall revenue fell 18.1% to $2.89 billion.

"We remain fully committed to playing the pioneering role in Macau's transformation into Asia's leading business and leisure tourism destination," Adelson said.

The company is opening two more Macau resorts next year, a St. Regis-branded hotel which is part of the Sands Cotai Central, and the $2.7 billion The Parisian Macao. In total, Las Vegas Sands will operate more than 13,000 hotel rooms in Macau.

"We have steadfast confidence in our future success," Adelson said.

The remarks came less than a week after Wynn Resorts Ltd. Chairman Steve Wynn provided a verbal beat down of Macau's policy concerning the number of gaming tables the government allows casino to operate. Wynn called the table game limits "the single most counter-intuitive and irrational decision that was ever made."

Analysts on the Las Vegas Sands conference call did not ask Adelson or Las Vegas Sands President Rob Goldstein about the table game caps.

"We have a belief our gaming license is a privilege and not a right. We have always been respectful of the Macau government's desires. We were the pioneer of the integrated resort business model. That's what the government wants. We will continue to do that," Adelson said.

On Monday, Nomura Securities gaming analyst Harry Curtis warned investors Macau's free-fall hadn't yet bottomed out. On Tuesday, Curtis said the Macau supply of casino versus the demand for gaming is "way out of whack." He believes the trend will continue throughout 2017, which spells trouble for Las Vegas Sands' Parisian, which is scheduled to open next summer.

Wynn Resorts and MGM Resorts International are also opening new properties in Macau next year.

"Capacity is growing at just the wrong time, when the value per customer is shrinking significantly," Curtis wrote in a research report. Goldstein called Macau "a question mark for any operator."

On the Strip, Las Vegas Sands grew revenue 1.3% in the quarter to $385.5 million at The Venetian Las Vegas and The Palazzo Resort Hotel Casino. Casino revenue at the two properties fell 22.5%, but the declines were off-set by a 34% increase in food and beverage revenue and a 19% jump in hotel revenue.

Adelson was exuberant about the Marina Bay Sands in Singapore, which grew overall revenue to $750.7 million in the quarter and increased cash flow 10.8%. He said the Marina Bay Sands "owns 65% of the market, double that of our competitor."

Malaysia-based Genting Berhad operates Resorts World Sentosa in Singapore, the only other resort in the market. "Genting never operated in a competitive market. We always have,” Adelson said.