Regtech firm Sumsub releases its first KYC guide for the gaming industry

Sumsub, an international regulatory technology company that helps businesses stay compliant and fight digital fraud, published this week its first KYC (Know Your Customer) guide for the gaming industry, with a focus on Europe and the UK.

“KYC for the gaming industry: Europe. A complete guide to balancing compliance, conversions, and fraud protection” tackles the main challenges that the industry faces today, such as staying compliant with KYC/AML regulations that vary from market to market, maintaining a high level of fraud protection, and building high-conversion verification flows.

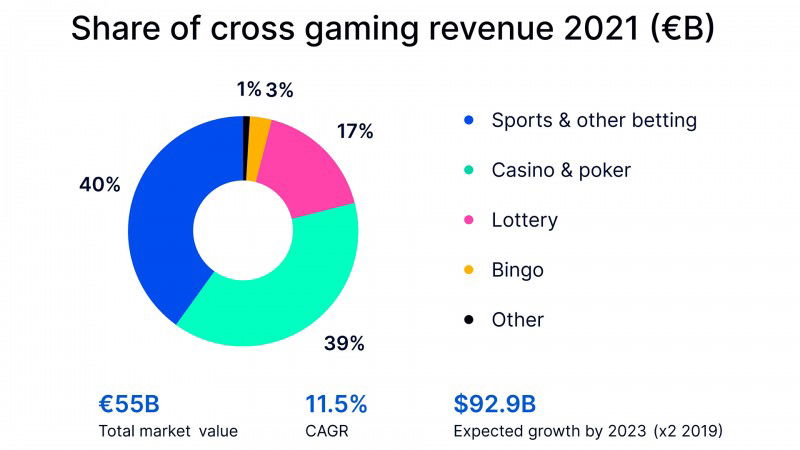

According to data citred by the company, the gambling market is set to grow by €140.05 billion from 2021-2026, and it notes this rapid growth also means greater exposure to different types of fraud attacks. "So while gambling platforms aim to onboard more users as fast as possible, they can also neglect compliance and security requirements. This can lead to massive fines and even licence revocation, with several multimillion-dollar fines already hitting several industry players in 2022," Sumsub points out.

“Compliance with local KYC/AML regulations is vital for gaming companies, as a single regulatory fine can easily cost millions and permanently disrupt their ability to operate," notes Andrew Sever, co-founder and CEO of Sumsub. "Our guide dives into the regulatory specifics for gambling platforms in the EU and the UK, providing insights on local regulation of state bodies, general requirements and individual market initiatives and policies.”

Compliance challenges for gambling operators include building effective KYC flows that meet the full range of European regulatory requirements, as each platform must develop a program in accordance with their gaming and market specifics. "Such programs should be secure and compliant, but also fast enough to keep user conversion high. This guide shares best practices and easy practical steps to setting up level-based verification flows without compromising onboarding speed," the regtech firm explains.

COVID-19 caused a surge of players joining #gaming apps and platforms. The industry is now expected to grow at an incredible pace, by €140.05 billion from 2021-2026. Still, #fraudsters never sleep…

— Sumsub (@Sumsubcom) August 17, 2022

Learn how verification levels work in online gambling: https://t.co/g0s6HzJ8PZ

Sumsub provides an all-in-one verification platform for detecting fraud and ensuring full compliance with global AML/KYC/KYB regulations, with operations in more than 220 countries and jurisdictions. It offers AI-driven anti-fraud tools to over 2,000 clients across the gaming, fintech, crypto, transportation, and trading industries.