Macau investment payback period for casinos extend from a year to decades amidst restrictions, uncertainty

Investment payback periods for casinos in Macau have now extended from just a year to decades. Whereas a venue like Sands Macau -the enclave’s first Las Vegas-style casino-, opened in 2004, was able to recoup its $256 million construction cost in just under a year, the situation has drastically changed in the last few years.

Even before the pandemic, new casino resorts were likely to see a payback period of more than five years, reports Bloomberg. This resulted from challenges from bulging construction costs to China’s crackdown on capital outflow.

However, now the Covid-19 pandemic, and its hit to visitation levels, have made the situation even worse, adding at least four years to that timeline. Analysts estimate now extended payback periods for operators after gaming revenue plunged 80% last year.

Adding another layer of uncertainty, operators are growingly concerned that new casinos in the gaming hub will no longer be a good investment under the revisions to the territory’s casino law. These are set to tackle the current gaming licenses periods of 20 years, which will be slashed after expiry in June.

“If the new concession term is shorter than 10 years, then it’s really difficult, if not impossible, for new projects starting after the concession to get payback within the period,” said JP Morgan analyst DS Kim, according to the previously cited news source. “The casino operator may end up losing half the concession period without getting anything.”

No Macau casino opened since 2015 has made back its initial investment before the pandemic. Before Covid halted tourism to the city, projects such as Wynn Palace and Sands China’s Parisian were on track to recoup construction costs within a decade, a scenario now less likely to occur.

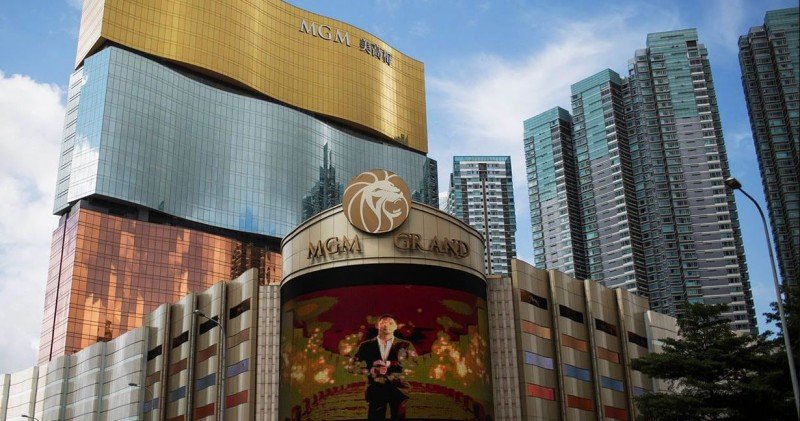

However, more recent projects, such as MGM China Holdings’ MGM Cotai and SJM Holdings’ Grand Lisboa Palace, which opened in 2018 and 2021 respectively, might even face an even worse outlook. Neither venue was running at full revenue-generating capacity before Covid-19.

In addition to troubles faced over the past decade, Macau casinos have also started to pile up debts over the past five years as a result of commitments to building new resorts and upgrading existing venues.

As a result, casinos in the enclave have issued about $28.6 billion in bonds since 2017. The figures account for more than 80% of the debt the industry has ever raised, claims Bloomberg.

Most borrowing remains outstanding, with the bulk of it maturing between 2024 and 2029. But while operators don’t have maturities in the next year or two, slow industry recovery leaves them with less room to manage other risks, such as government policy changes.

Certain resorts in the region, such as those operated by Wynn Resorts and Melco Resorts & Entertainment, have been downgraded by analysts, citing slow gaming recovery amid travel restrictions and high company leverage. These downgrades could be reflected in higher borrowing costs going forward.

The extended investment payback periods come amidst general uncertainty resulting from proposed gambling revisions, as China expects Macau to diversify its economy away from gaming. These could involve measures such as sending government representatives to supervise casinos, approving the companies’ dividends, and increasing local ownership in the firms.