Who dominates the US gambling markets? North vs. South America

Top providers, games, player engagement rates, and market size.

The online gambling landscape across the Americas reveals a tale of two markets evolving at different paces, with distinct player preferences and growth trajectories. While North America boasts a mature, high-revenue market dominated by the United States, South America is emerging as the industry's fastest-growing region, with Brazil leading the charge. CasinoRank’s data-driven analysis examines the market size, player engagement, popular game categories, and top providers to determine which continent truly dominates the gambling ecosystem.

iGaming industry in the USA

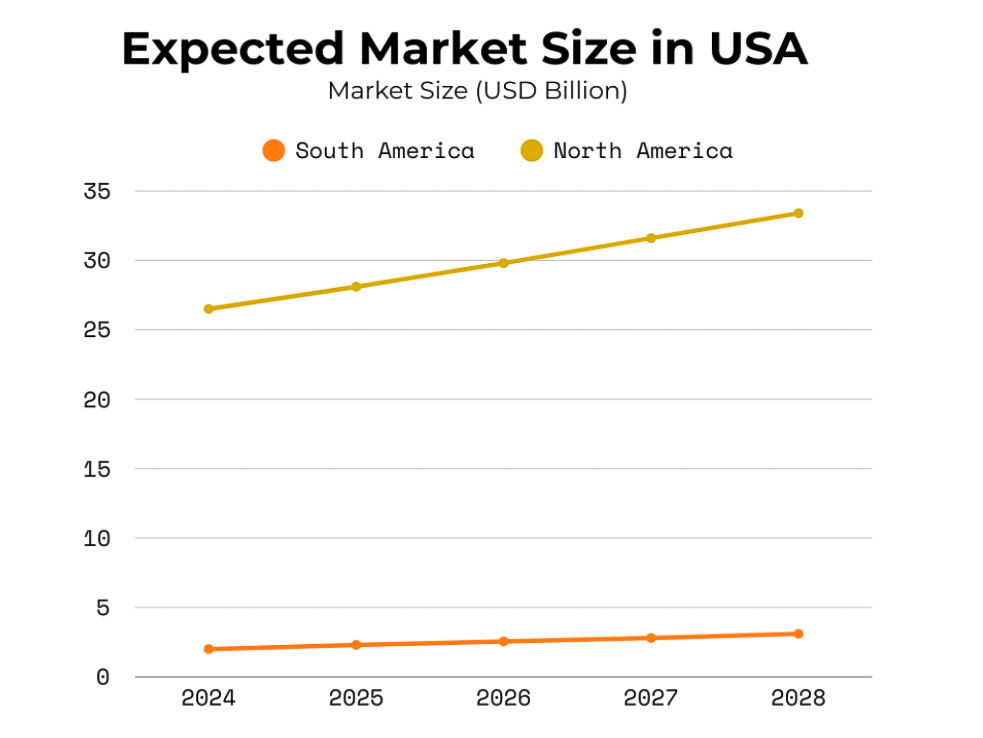

The contrast between North and South America's gambling markets is stark. North America's online gambling sector generated approximately $25 billion in gross gaming revenue (GGR) in 2024, with the United States contributing about $22–23 billion from sports betting and casino operations. Meanwhile, South America's entire market reached only $1–2 billion, though it leads globally in growth with a projected 13.7% CAGR from 2023–2028.

Based on Grand View Research‘s data, North America holds 20–25% of global online gambling revenue, second only to Western Europe's 36%. South America, though smaller, is on a rapid upward trajectory, driven by evolving regulations.

South America gambling market

South America's online gambling market is experiencing transformative growth, albeit from a smaller base than its northern counterpart. Based on Cognitive Market Research’s data, the Latin American online gambling market is expected to reach a projected revenue of USD 13.48 billion by 2030, growing at a CAGR of 10.4% from 2024 to 2030.

South America: Top 3 online gambling markets

Brazil

In 2024, Brazil’s online gambling market is estimated to be worth around USD 9.69 billion, making it one of the largest and most promising in Latin America. The recent legalization and licensing of online sports betting and casinos have significantly expanded opportunities for both local and international operators. Football (soccer) remains the dominant force in the Brazilian betting landscape, with a large portion of the population actively participating in online wagers, reflecting the country's deep-rooted passion for the sport.

Argentina

Argentina's online gambling market is valued at approximately USD 3.80 billion. The growth of the sector has been largely driven by regulatory changes and the adoption of new technologies that have made digital gaming more accessible and secure. Additionally, there has been a noticeable rise in player participation across the country, with a growing number of platforms offering a wide variety of gaming options to meet diverse consumer preferences.

Colombia

Colombia's online gambling market is estimated to be worth around USD 2.01 billion. The country's proactive legislation and well-structured regulatory framework have positioned it as a regional leader in the iGaming space. This forward-thinking approach has not only created a stable and secure environment for operators and players alike but has also attracted significant international investment, further solidifying Colombia’s reputation as a mature and promising market in Latin America.

North America: Top 3 online gambling markets

North America's gambling momentum stems largely from the U.S., following the repeal of PASPA in 2018. By 2024, over 30 U.S. states had legalized sports betting, with seven offering regulated online casino play. This has created a dynamic market generating $14 billion from sports betting and $8 billion from casino activity.

Approximately 54 million Americans engage in online sports betting. Online casino gaming contributes 38% of the U.S. online gaming revenue, showing a balanced vertical profile. Canada also plays a notable role, with Ontario alone generating CAD $1.4 billion and over one million active accounts in its first regulated year.

United States

In 2024, the online gambling market in the United States was valued at approximately USD 16.56 billion, reflecting its position as one of the most mature and dynamic markets in the Americas. The rapid growth has been largely driven by the widespread legalization of sports betting across numerous states, along with the continued expansion of online casino offerings. Key trends shaping the industry include the increasing popularity of mobile betting and the rise of in-play wagering, which allows users to place bets in real-time during events. Additionally, the integration of AI technologies is playing a growing role in enhancing both user experiences and platform security, marking a new phase of innovation in the U.S. iGaming sector.

Canada

Canada's online gambling market is projected to reach USD 4.19 billion in 2024, reflecting steady growth fueled by key regulatory changes. The legalization of single-event sports betting in 2021, along with the move by provinces to regulate online gaming platforms, has established a more structured and secure environment for operators and players alike. This regulatory clarity has encouraged market participation and innovation. In addition, Canadians are showing increasing interest in online casino games, poker, and sports betting, with the trend further amplified by the widespread use of mobile devices and the availability of reliable, secure payment options.

Mexico

Mexico stands out as one of the largest iGaming markets in Latin America, with real-money gaming generating an annual turnover comparable to that of Brazil, exceeding USD 10 billion. The country's strong market performance is fueled by a large and engaged user base, coupled with a deep-rooted cultural affinity for gambling. Despite ongoing regulatory uncertainties, the online gambling sector remains resilient and continues to expand, with a significant portion of the adult population actively participating in digital betting and casino platforms.

Player engagement: Most played game types

North America

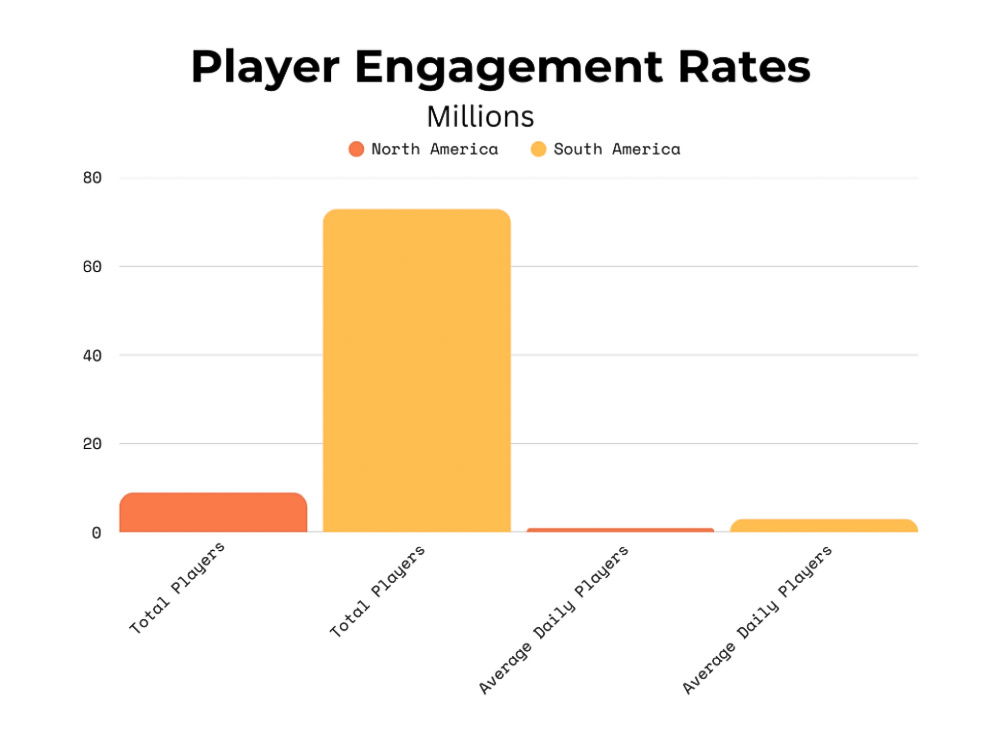

North American gamblers are highly engaged. In the U.S., 70% of sports bettors play weekly, 42% place bets multiple times per week, and 25% do so daily. FanDuel alone reported 1 million daily users in March 2024, contributing to an estimated 3 million daily active gamblers across the continent.

According to Env Media, the average U.S. online casino player wagered about $8,500 over 12 months—vastly above the $1,300 global average.

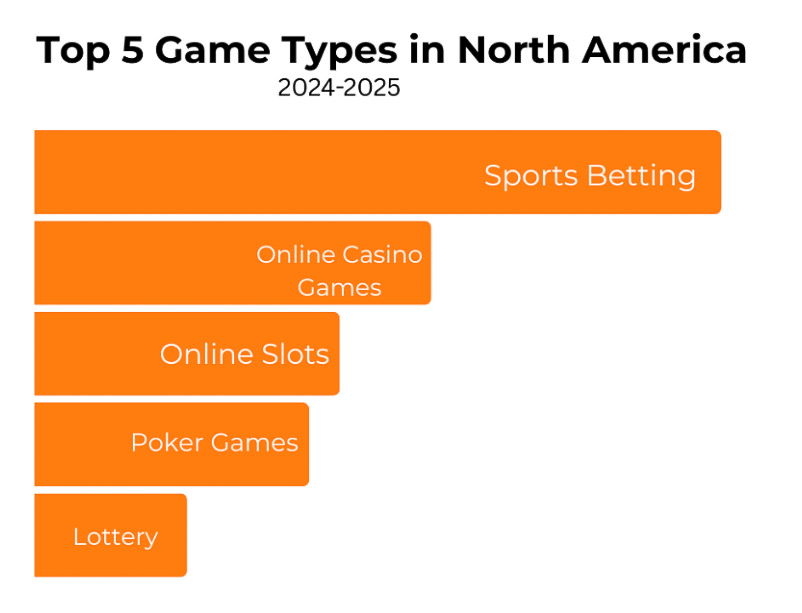

Top Played Games:

- Sports betting (NFL, NBA, MLB, college sports)

- Table games (blackjack, roulette)

- Online slots

- Online poker

- Lottery

Sports betting accounts for 62% of U.S. revenue, with casino games providing the remaining 38%.

South America

South American users engage less frequently. In Brazil, 61% of players gamble monthly or less, and only 8% daily. 42% spend under 30 minutes per week on iGaming, and 68% under an hour.

Despite this, providers report higher daily player averages in South America. Evolution, for instance, logged 518 average daily players, compared to 146 in North America.

Top played games, provided from Env Media data:

- Sports betting (mainly football/soccer)

- Lottery

- Online slots

- Online card games

- Bingo

Innovative games such as crash and fish table games are also gaining traction, especially among younger, mobile-centric users.

Top Providers by Continent

The iGaming landscape in the Americas reveals distinct market dynamics between North and South America. While both regions feature key global players, differences in market maturity, regulation, and player preferences have shaped unique competitive environments. North America exhibits a more fragmented supplier base, while South America leans toward greater concentration among top providers. The following sections explore the leading iGaming companies in each region and their roles in shaping the evolving market landscape.

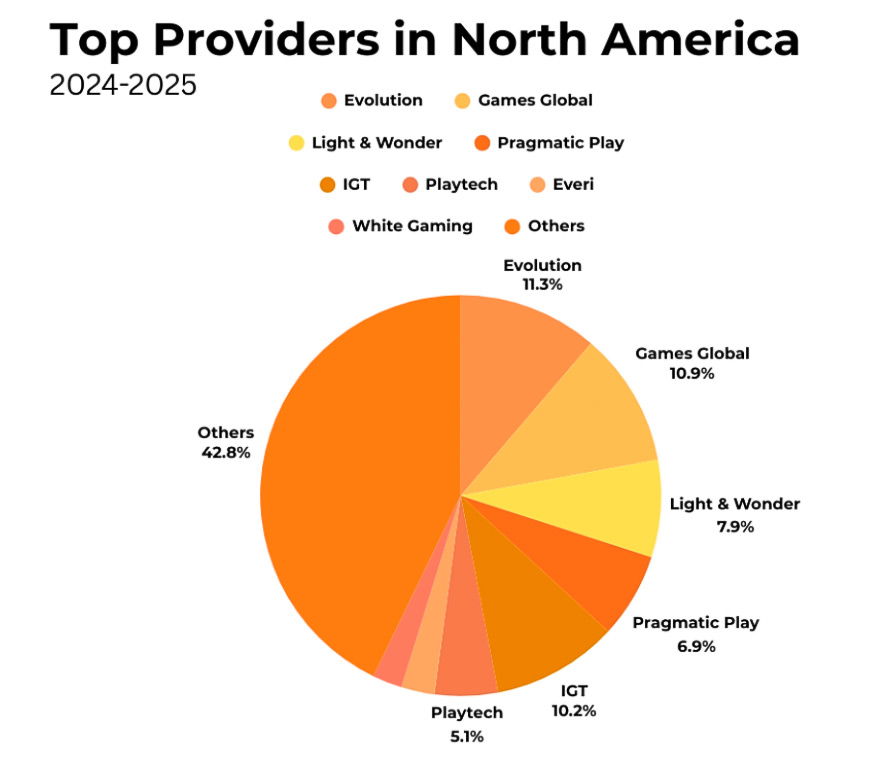

Top providers in North America

North America's supplier landscape features greater fragmentation than South America, with a substantial 40.1% market share held by providers outside the top nine. Among identified suppliers, Evolution leads narrowly with 11.3% market share. This competitive distribution reflects North America's more mature market with established regulatory frameworks that have enabled multiple suppliers to build substantial presences.

Here are the top game providers in North America, according to iGaming Tracker:

- Evolution – 11.3%

- Games Global – 10.9%

- IGT – 10.2%

- Light & Wonder – 7.9%

- Pragmatic Play – 6.9%

- Playtech – 5.1%

Other less-known providers account for 42.8%, reflecting a diverse ecosystem rooted in land-based casino partnerships and strict compliance structures.

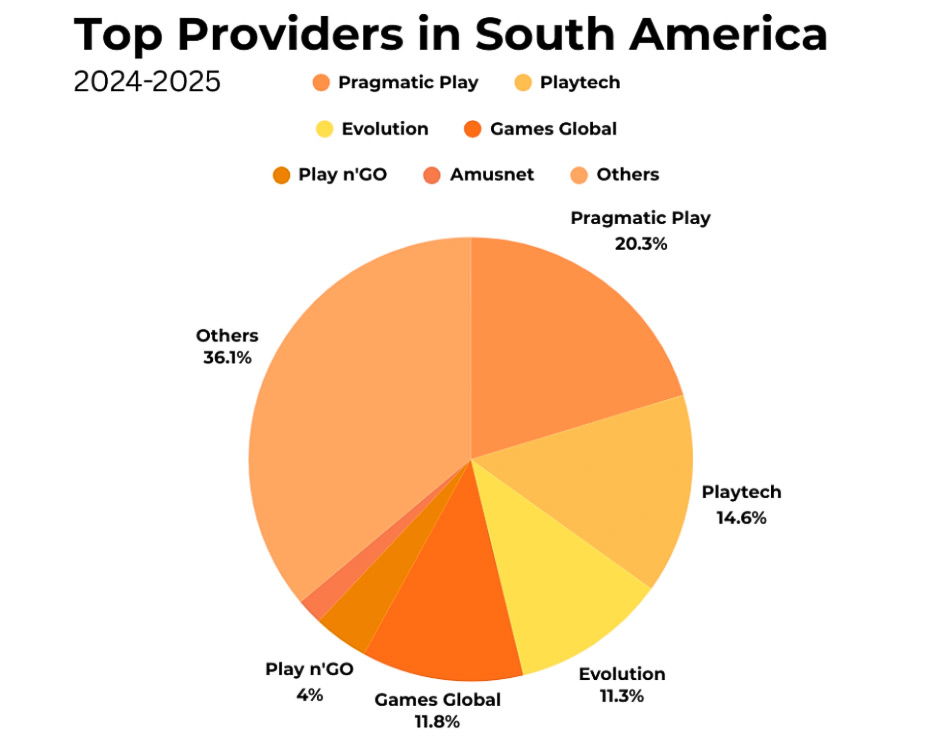

Top providers in South America

South America's supplier ecosystem shows greater concentration among leading providers, with Pragmatic Play claiming a dominant 20.3% market share. Collectively, the top six providers control 69.4% of the market, compared to 59.9% for North America's top nine. Pragmatic Play's regional leadership reflects its strong focus on Latin American markets and portfolio alignment with local preferences. Playtech's strong second position stems from its established presence in regulated Latin American markets, particularly in Colombia.

Here are the top game providers in South America, according to iGaming Tracker:

- Pragmatic Play – 20.3%

- Playtech – 14.6%

- Games Global – 11.8%

- Evolution – 11.3%

- Play’n GO – 4.0%

- Amusnet – 1.9%

Other less-known providers account for a total of 36.1% of the market.

North America vs South America: Trends & Data

According to Cognitive Market Research and Grand View Research, key differences between the continents include:

- Market Size: North America boasts 73 million online gamblers vs. South America’s 8–9 million.

- Daily Actives: 3 million in North America vs. 1 million in South America.

- Vertical Balance: North America shows a 62/38 sports/casino split; South America remains overwhelmingly sports-focused.

- Engagement Patterns: North America has higher frequency and session duration; South America has higher average daily player numbers for certain providers like Evolution.

- Regulation: North America has more mature regulatory frameworks; South America is still building its infrastructure, especially in Brazil.

Conclusion: Which continent dominates?

North America dominates in terms of size, revenue, and user base, generating over $25 billion in annual revenue and supporting tens of millions of gamblers. However, South America's growth, driven by Brazil’s regulatory reforms and mobile-first culture, points to a promising future.

While North America leads today, South America's 13.7% CAGR and shifting regulatory landscape suggest it may soon rival its northern counterpart. Both regions are set to be iGaming titans—each shaped by unique consumer behaviors and cultural influences.