MGM's revenue up 88% to $9.7B in 2021 driven by Strip properties, record Q4 performance

Gaming and hospitality giant MGM Resorts International shared on Wednesday its financial report for the fourth quarter and full-year 2021. The company posted consolidated net revenues of $9.7 billion for FY21, an increase of 88% over the prior year, and net income attributable to the business of $1.3 billion, compared to a $1 billion net loss in 2020. It also posted consolidated Adjusted EBITDAR of $2.4 billion in the period.

The full-year achievements come on the back of a record fourth quarter, in which the company posted consolidated net revenues of $3.1 billion, an increase of 105% compared to the prior-year quarter, which was negatively affected by temporary closures and restrictions no longer in place. Net income was at $131 million, up from a net loss of $448 million; and consolidated Adjusted EBITDAR reached $821 million.

"Our record fourth-quarter results are a testament to our talented team across the globe, our sharpened focus on operational efficiency and the proven resiliency of demand for the service and experiences that we provide," said Bill Hornbuckle, Chief Executive Officer and President of MGM Resorts International. "The strategic milestones we achieved in 2021 position us for further success in 2022, and we remain excited about our long-term opportunities.”

According to the CEO, these include leading the US sports betting and iGaming market through BetMGM, pursuing geographic expansion such as the Japan integrated resort, and reinvesting in its core business to drive sustainable growth. As part of these efforts, the business has recently launched its new loyalty program, MGM Rewards, which offers “an enhanced and further streamlined experience” to its members.

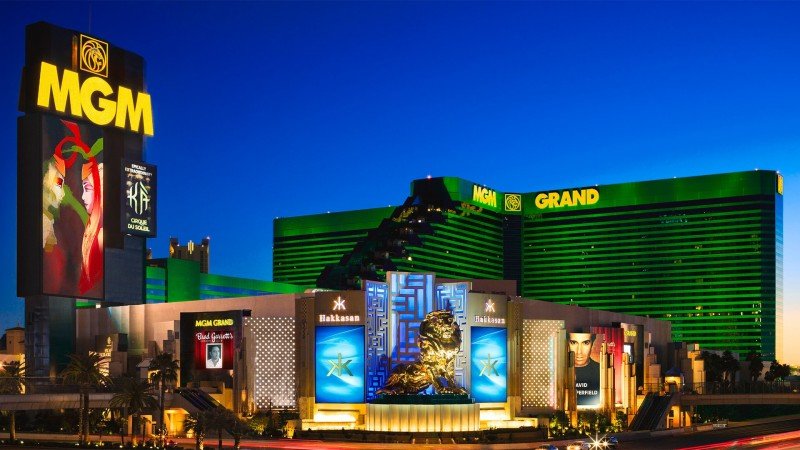

The record cash flow and margins delivered in Q4 were driven by the company’s Las Vegas Strip properties and in regional markets across the country, delivering some numbers which even exceeded figures from pre-pandemic years.

In Q4, MGM’s Strip properties posted $1.8 billion in revenue, up a record 277% from 2020, but also up 26% from pre-pandemic Q4 2019. This is partly credited to the operator taking over the Aria and Vdara properties, and the easing of pandemic-related restrictions.

Meanwhile, regional operations reported net revenues up 51% to $900 million compared to the prior year, and flat compared to the fourth quarter of 2019. Adjusted Property EBITDAR was $309 million, an increase of 95% against 2020 and of 36% compared to Q4 2019.

The gaming and tourism industries in the US recovered from the pandemic in 2021 at a pace that defied most predictions, with casinos in Nevada recording record-high figures, and December marking the 10th straight month in which the state exceeded $1 billion in gaming win.

"In 2021, we further bolstered our liquidity position while returning $1.75 billion to shareholders via share repurchases and making strategic investments that align with our vision to be the world's premier gaming entertainment company," said Jonathan Halkyard, Chief Financial Officer and Treasurer of MGM Resorts International.

The CFO reiterated the company’s commitment to “maximizing long-term shareholder value,” with the company’s capital allocation strategy continuing to be anchored in three key priorities: maintaining a strong balance sheet, programmatically returning cash to shareholders, and investing in targeted growth opportunities.

While the company’s US operations were the clear winner for Q4, MGM China posted net revenues of $315 million, a slight 3% increase year-over-year. However, this was significantly down -57%- from the fourth quarter of 2019, with Macau operations still feeling the impact of travel and entry restrictions amids the Covid-19 pandemic.

The company has a number of recent developments to look forward to completing in the future, including an agreement to sell 100% of the equity interests of The Mirage to an affiliate of Seminole Hard Rock Entertainment for cash consideration of $1 billion, expected to close during the second half of 2022.

And in January, the company announced that it would be investing $450 million more into BetMGM, its joint venture with Entain for iGaming and sports betting in the US. Following a positive New York launch, the brand now expects to deliver net revenue from operations of over $1.3 billion from a prior $1 billion forecast in 2022.