Why mobile payment options are dominating online casinos in 2024

The casino industry has seen its fair share of evolution. From cash transactions to the rise of credit cards, each era marked a shift. Now, in 2024, mobile payment options dominate. This move mirrors broader trends toward digital solutions. Consumers now prefer the convenience and security these methods offer. Technology's role in gambling has grown, too. It's not just about making payments more manageable. It's about making the whole process more integrated and user-friendly. Mobile payments are at the heart of this transformation. They link technology's impact on gambling with the casino industry's evolution. This blend has reshaped how people interact with gambling sites, making access to games more immediate and secure.

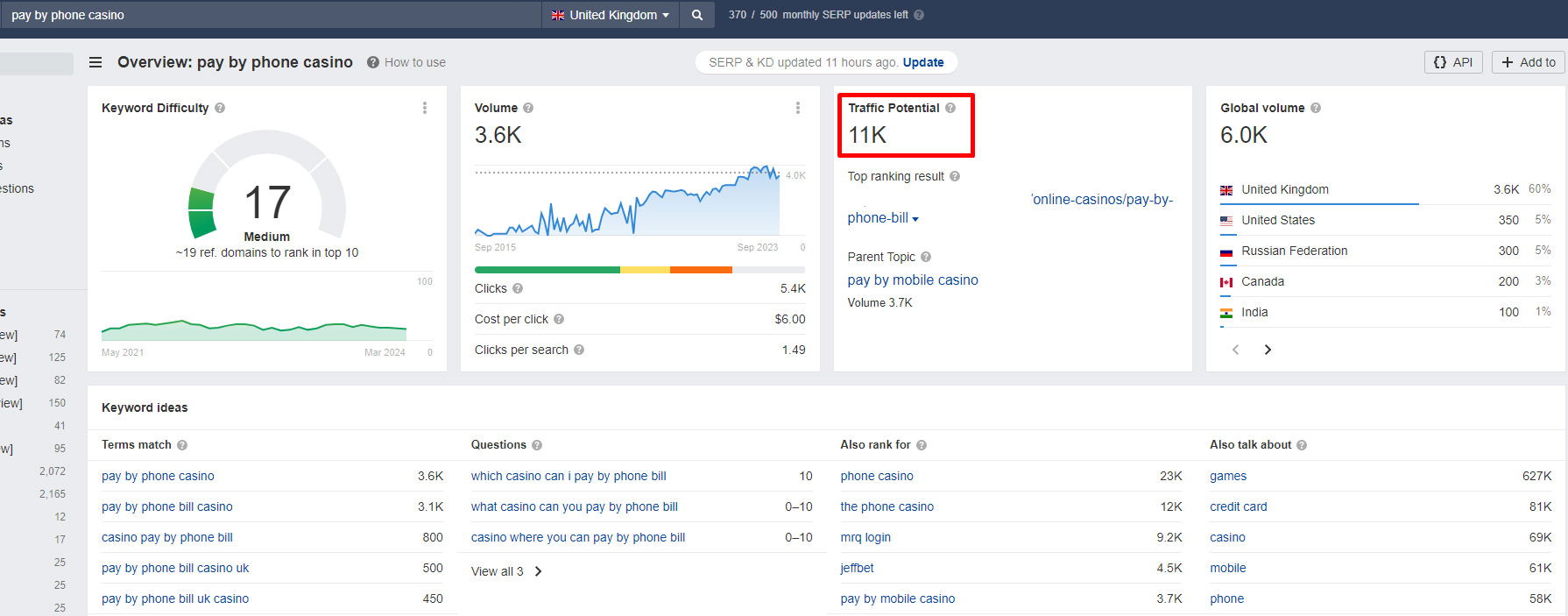

A picture from the Ahrefs service shows that British players are looking for casinos that

support payment by phone approximately 11,000 times a month.

The Rise of Mobile Payments in Casinos

Source: https://www.finder.com/uk/banking/mobile-internet-statistics

Statistics paint a clear picture: over 87% of adults now own a smartphone, with a significant portion using their devices for online gambling. This widespread smartphone usage in gambling has created a fertile ground for mobile payment adoption. Moreover, mobile payment technology has leapt forward. Higher security features, faster transaction speeds, and more all-around acceptance are the norm.

This evolution means users can deposit funds or cash out winnings with a few taps. It's this ease of use and immediacy that makes sense to today's gamblers. As a result, casinos have quickly adapted, integrating these technologies to meet player expectations. This integration has improved user interaction and enlarged the market, attracting a more tech-savvy demographic. The shift towards mobile payments in casinos is a clear indicator of the digital age's impact on gambling.

Benefits Over Traditional Payment Methods

Mobile payments stand out against traditional casino payment methods, such as cash or credit/debit cards. The benefits are clear and compelling.

- For starters, the convenience of mobile payments is unmatched. Players can transfer funds or withdraw winnings with just a few taps on their smartphones – no need to queue at ATMs or deal with the physical handling of money.

- Speed is another significant advantage. Transactions via mobile are instantaneous. This efficiency means players can focus more on playing the games rather than waiting on payment processing.

- Security is a top priority, too. Mobile payments leverage advanced encryption and authentication technologies, offering more secure casino transactions than ever.

- In the context of a post-pandemic period, the reduction of physical contact is a noteworthy benefit. Mobile payments minimize the need to touch surfaces or exchange cash, addressing health concerns and offering peace of mind to health-conscious players.

Together, these factors make mobile payments an attractive option for gamblers. They not only streamline the feelings but also align with the demands of a digital, fast-paced lifestyle. The shift towards mobile over traditional payments signals a significant change in how casinos operate, prioritizing efficiency, safety, and user satisfaction.

Mobile Payment Future Prospects

The future of mobile payments in the gambling industry looks bright. Technological advancements are set to further elevate the accessibility and security of casino transactions. We can anticipate even more effective integration of mobile payment methods, with biometric verifications such as fingerprint and facial recognition becoming commonplace. This will bolster security, making each transaction faster and much safer.

The adoption rates of mobile payments are expected to climb as casinos continue to refine their digital offerings. This will likely lead to a broader acceptance of cryptocurrency and blockchain technology, offering players anonymity and reducing transaction fees.

Such trends indicate a significant shift towards more user-friendly and secure gambling environments. The focus on technology reflects the industry's commitment to meeting player demands for convenience and safety, ensuring the sustained growth of mobile payments in the gambling sector.

Best Pay By Mobile Payment Methods in the UK

This trend has spurred the development of several mobile payment services, each offering unique attributes to meet the needs of users. Here are some of the premier mobile payment methods available in the UK, designed for secure, quick, and easy transactions.

Boku

Boku permits users to make purchases and bill them directly to their mobile phone bill, eliminating the need for credit or debit card use in online transactions. Accepted by various online services, including gaming sites and streaming platforms, Boku offers a convenient payment method. One of the critical advantages of using Boku is the level of security it offers. Since the service does not require users to enter credit card details or other sensitive financial information online, it significantly reduces the risk of financial fraud and identity theft.

Despite its benefits, users should be aware of the potential downsides, such as limited refund capabilities and spending restrictions, which might not suit everyone's needs. Furthermore, not all mobile network operators support Boku, which can limit its availability to certain users.

Siru Mobile

This service negates the necessity for traditional payment methods like credit or debit cards, particularly benefiting those who seek an alternative or do not have access to these financial tools. Siru Mobile's operation hinges on a precise principle: enabling payments through mobile devices without requiring banking information or credit card details at the point of sale. Users simply select Siru Mobile as their payment option on supported websites, enter their mobile number, and confirm the transaction. The charge for the purchase is then added to their monthly phone bill or deducted from their prepaid balance, depending on their mobile plan.

Zimpler

Zimpler is a Swedish fintech company that has been making waves in the online payment industry with its user-friendly and efficient payment solutions. Founded with the vision to simplify payments for users and businesses alike, Zimpler has grown into a reputable service known for its ease of use, speed, and security. It also integrates directly with your online banking, allowing immediate transactions between your bank account and the merchant. To use Zimpler, customers select it as their payment option at checkout on a merchant's website, enter their mobile number, and follow a quick verification process. They can then choose to pay directly from their bank account or opt for an invoice that can be paid at a later date.

Payforit

Payforit is primarily used to purchase digital content and services online, such as apps, games, eBooks, and streaming services. Its ease of use and secure transaction method make it particularly useful for quick and small-value purchases, offering a hassle-free alternative to conventional online payment methods. While Payforit offers numerous benefits, it's important for users to be aware of its limitations, such as the spending cap, which may restrict large purchases. Additionally, it's vital to keep an eye on monthly phone bills to monitor for any unexpected charges, ensuring that all transactions are recognized and authorized.

PayViaPhone

By linking payment transactions directly to the user's mobile phone bill or prepaid balance, PayViaPhone simplifies the checkout process, enabling fast and secure payments without the need for credit cards or bank accounts. This payment method is particularly appealing in today's fast-paced digital globe, where consumers seek quicker and more secure transaction methods. When making a purchase online or subscribing to a service that accepts PayViaPhone, customers choose this option at checkout. They are then prompted to enter their mobile phone number. A confirmation code or a verification message is sent to their phone to authorize the transaction. Once confirmed, the charge is either added to their monthly mobile phone bill or deducted from their prepaid balance, depending on their account type.

PayViaPhone partners with several mobile operators to provide its services, ensuring broad coverage and accessibility for users across different networks. While the specific mobile operators supporting PayViaPhone can vary by region, the service typically collaborates with major networks to maximize its reach. In the UK, for example, prominent mobile operators such as EE, O2, Three, and Vodafone often support similar mobile payment services. Users are encouraged to check with their mobile operator or the PayViaPhone service directly to confirm compatibility and availability.

Apple Pay

Apple Pay is Apple's innovative payment technology that has transformed how consumers conduct transactions. Launched in 2014, it provides an easy, secure, and private way to pay using your iPhone, Apple Watch, iPad, and Mac. Apple Pay has become increasingly popular due to its emphasis on security and privacy, allowing users to make purchases in stores, through apps, and on the web without sharing their card information directly with merchants.

Apple Pay uses Near Field Communication (NFC) technology to enable contactless payments at point-of-sale terminals. To use Apple Pay, users add their credit, debit, or store cards to the Wallet app on their Apple device. When making a purchase, users simply hold their device near a payment terminal and authenticate the transaction using Touch ID, Face ID, or their device passcode. For online or in-app purchases, Apple Pay is selected as the payment method and authenticated in a similar manner.

Google Pay

Google Pay, rebranded from Android Pay in 2018, represents Google's unified payment service that combines the functionalities of its former iterations and Google Wallet. It's designed to offer users a convenient, secure, and fast way to make payments online, in apps, and in stores using their mobile devices. Compatible with Android phones, tablets, or watches, Google Pay has quickly become a staple for contactless payments worldwide, thanks to its integration of innovative technologies and broad merchant acceptance.

Google Pay uses Near Field Communication (NFC) technology for contactless payments in stores, similar to Apple Pay. Users can add credit, debit, loyalty, and gift cards to the Google Pay app on their Android devices. To make a payment, the user unlocks their device and holds it near a payment terminal that supports contactless payments. For online and in-app purchases, Google Pay can be selected as the payment option, facilitating a soft transaction without the need to enter payment details manually.

Fonix

Fonix is a UK-based mobile payment and messaging service provider that specializes in carrier billing solutions. It allows users to make purchases and charge them directly to their mobile phone bill or prepaid balance. This innovative approach to payments harnesses the ubiquity of mobile phones, offering a secure alternative to traditional payment methods.

Fonix operates on a direct carrier billing system, which means it facilitates transactions by charging the cost of purchase directly to the user's mobile phone bill. This is done without the need for credit card information or bank account details, making it an accessible option for a wide range of users. To make a payment with Fonix, a customer simply selects the option at the point of sale (online or via a mobile app), confirms the purchase, and the charge is applied to their mobile bill or deducted from their prepaid balance.

Top 5 Casinos That Support Mobile Payment Options

Below are some top pay-by-mobile casinos, which are considered the most reliable ones. These UK casino sites accept mobile payments without problems, offering users convenience and security at the same time.

MrQ Casino

MrQ leads the pack as the premier UK casino for pay-by-phone options. This casino offers a convenient pay-by-phone feature for users subscribed to O2, 3, EE, or Vodafone. Housing a remarkable array of slots and gaming options from top-tier developers in the industry, MrQ creates a rich gaming process. Furthermore, newcomers to the site are greeted with an amazing offer with wager-free spins on the prominent slot game.

Pros:

- Welcome bonuses without wagering requirements.

- A large library of over 3400 games.

- Zero additional fees.

- Quick withdrawal times, ranging from immediate to 7 days.

Cons:

- Live casino options are quite limited.

- Absence of any VIP program.

Luck Casino

Launched in 2023, Luck Casino has progressively established its footprint in the digital arena. Managed by Viral Interactive Limited, the establishment has demonstrated a harmonious blend of functionalities with a steadfast commitment to player honesty, which has contributed to its increasing acclaim. Luck Casino accommodates various mobile payment options, including Trustly, Pay by Phone, and Vyne, making deposits available for anyone.

Pros:

- Luck Casino boasts an extensive array of over 1,700 slot games.

- The casino's website is designed for ease of use.

- Players have direct access to games with superior return rates.

- Players can take advantage of numerous promotional offers and bonuses.

Cons:

- Despite its strengths, the live casino section offers a restricted selection.

- The lack of phone support limits communication channels for players seeking assistance.

Netbet

Established in 2001, Netbet Casino has become a prominent name in the online gaming industry. In 2022, the casino boasted a 94.76% Payout Rate, demonstrating its commitment to fair and rewarding gameplay. Operated by NetBet Enterprises Ltd, a leading entity in the field, the casino maintains its reputation for excellence. Among available mobile payment systems, Netbet supports Paysafecard, Trustly, PayZ, Apple Pay, and Yaspa.

Pros:

- Unique features like SnapBet and Bet Maker improve sports betting.

- The casino's intuitive interface facilitates easy navigation.

- New players are greeted with great welcome bonuses.

Cons:

- The range of jackpot games is limited.

- There's a scarcity of ongoing promotions for existing players.

JeffBet

As an online gambling enterprise, Jeffbet was established in 2022. Among products, online slots, live dealer games, and table games are available for UK players. Holding regulatory gambling licenses in both the UK and Malta, the organization keeps its compliance and credibility. Jeffbet accepts PayviaPhone, Apple Pay, Paysafecard, PayZ, Skrill, Neteller, and Neosurf.

Pros:

- JeffBet UK offers a broad spectrum of sports for betting.

- JeffBet provides cashback on deposit losses for specific sports and significant events.

- The casino has dual licenses from two esteemed gambling authorities.

Cons:

- JeffBet imposes a 1% withdrawal fee on all transactions up to £3.

- Currently, the casino lacks a dedicated mobile app for its users.

Monster Casino

Since 2021, Monster Casino has swiftly asserted itself in the landscape of UK online gambling. Operated by ProgressPlay Limited, the casino distinguishes itself through its contemporary take on online gaming, catching players seeking a rich and innovative gaming atmosphere. Monster Casino accepts deposits made with PayviaPhone, Apple Pay, Paysafecard, PayZ, Skrill, and Neteller.

Pros:

- Mobile-friendly interface.

- No withdrawal limits.

- Sports betting options are available.

Cons:

- Presence of withdrawal fees.

- Skrill and Neteller deposits are ineligible for most promotions.

Final Thoughts

The dominance of mobile payment options in the casino industry by 2024 is undeniable. The evolution from traditional methods to digital solutions reflects a shift towards convenience, speed, and security. With increased smartphone usage and advancements in mobile payment technology, players now prefer the effortless functionality these options provide. The modern emphasis on reducing physical contact has only accelerated this trend.

Author’s Bio

Jamie Wall, a former game developer, leverages his deep understanding of casino game essence in his role as an analyst at Gamblizard. Jamie is responsible for providing unbiased reviews and detailed analyses, mainly focusing on such games as blackjack, poker, and slots. He is particularly interested in the potential of virtual reality technology in the ever-evolving gambling industry.