Australian financial watchdog launches legal action against Crown for alleged AML, CTF breaches

The Australian Transaction Reports and Analysis Centre (AUSTRAC) has commenced civil penalty proceedings in Federal Court against Crown Melbourne and Crown Perth, the financial intelligence agency announced on Tuesday.

The action was launched for alleged “serious and systemic non-compliance” with the country’s anti-money laundering and counter-terrorism financing laws, AUSTRAC explains. It follows detailed enforcement investigations into the venues, operated by Australian gaming giant Crown.

According to The Guardian, the 863-page lawsuit filed on Tuesday says ongoing failures accounted for up to 547 breaches of anti-money laundering laws. Each alleged breach of the law, if proven, could attract a penalty of up to AUD $22.2 million ($16.2 million), meaning a fine could exceed AUD $12 billion ($8.8 billion), although a far smaller penalty is highly likely.

“AUSTRAC’s investigation identified poor governance, risk management and failures to have and maintain a compliant AML/CTF program detailing how Crown would identify, mitigate and manage the risk of their products and services being misused for money laundering or terrorism financing,” said AUSTRAC CEO Nicole Rose.

Rose claims that, by failing to meet its AML/CTF obligations, Crown made its business -and Australia's financial system- vulnerable to criminal exploitation. Additionally, the executive explains Crown failed to carry out appropriate customer due diligence, including on some “very high-risk customers,” leading to widespread non-compliance over a number of years.

“AUSTRAC has taken this strong action to achieve enduring change and ensure that Crown will fully meet their obligations to protect themselves and Australia’s financial system from criminal activity,” added the AUSTRAC CEO.

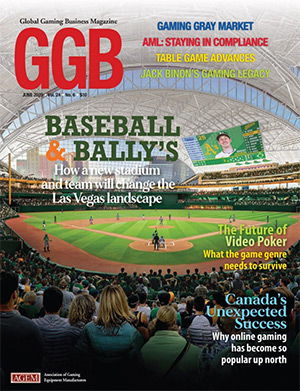

Among the agency allegations are a failure to properly assess money laundering and terrorism financing risks faced; not including in AML/CFT programs appropriate risk-based systems and controls; and a failure to establish an appropriate framework for board and senior management oversight of the programs.

Additionally, AUSTRAC argues James Packer’s Crown lacked an appropriate transaction monitoring program to identify suspicious activity, as well as lacking an appropriate enhanced customer due diligence program. These failures allowed the movement of money in non-transparent ways.

James Packer, Crown's largest shareholder

From March 2016, about 60 high-risk customers turned over AUD $70 billion ($51.1 billion) at Crown’s properties, pumping AUD $1.1 billion ($803 million) in losses into the company’s coffers, further reports the cited news source.

Additionally, the regulator alleges that many customers engaged in large cash transactions and transacted with cash that appeared “suspicious,” including cash in plastic bags, shoeboxes or cardboard boxes, cash in rubber bands, small denominations of notes, and counterfeit cash.

“This is an important reminder to all casinos in Australia that they must have a strong anti-money laundering program in place to protect their business and the community from serious and organized crime,” the AUSTRAC warned.

Crown said it is currently reviewing the statement of claim filed with the court, and that the company has now developed “a comprehensive remediation plan” intended to position Crown “as a leader in the industry” in governance, compliance, responsible gaming and management of financial crime risk.

The lawsuit filed by AUSTRAC builds upon allegations against Crown’s casinos which first surfaced on local media in 2019. This led to inquiries in both NSW and Victoria, which found that Crown had facilitated money laundering at its Melbourne and Perth venues.

It also comes amid a $6.3 billion takeover offer from US private equity firm Blackstone, which the Crown board has decided to unanimously back. The buyout proposal would provide Packer an exit from the Australian giant, bringing an end to his era in the company, while also maximizing value for shareholders, according to the business.

AUSTRAC's lawsuit could play a key role in the finalization -or a lack thereof- of the proposed transaction, reports Australia Financial Review. As the regulator hit Crown with allegations of more than 500 breaches of AML and CTF provisions, the claims could amount to more than AUD $1 billion in penalties ($730 million): a clause in the proposal allows Blackstone to drop the offer if Crown faces penalties over AUD $750 million, casting doubt over the deal.

While allegations about poor anti-money-laundering practices at Crown were in discussion for years now, AUSTRAC's scrutiny reveals some of the misconduct could have happened during and after the Victorian and West Australian royal commissions were launched. This would, in turn, cast doubt over the company's alleged "path to reform." The cited source reports that AUSTRAC claims one patron, allegedly linked to money-laundering risk related to human trafficking, was believed to still be doing business with Crown even after the Victorian royal commission was in place.

Should AUSTRAC win its case and a penalty ultimately be handed down by the Federal Court, analysts estimate it may reach AUD $400 million. However, a fine is hard to determine, as the court could take into account profit made by the business due to dubious junket revenue and savings made over the years from avoiding proper investments in compliance and AML/CTF controls.