Pennsylvania bill proposes licensing framework for skill games without new tax burden

A new bill introduced by Representative Kerry Benninghoff this week aims to formalize the regulation of skill games across Pennsylvania, but without imposing any new taxes or fees. The legislation marks a departure from other proposals circulating in Harrisburg, including Governor Josh Shapiro’s push for a 52% tax rate.

House Bill 1619 would legalize and regulate the distribution and operation of skill game terminals, grandfathering in machines already in operation. Rather than introducing a new tax regime, the bill proposes that the games remain subject to existing tax structures, such as the state’s sales tax and personal income tax requirements.

“No additional taxes or fees, including amusement taxes, shall be imposed on the placement or operation of a skill game or on the revenue generated by a skill game terminal unless specifically authorized under this act,” the bill reads.

Benninghoff had signaled this approach earlier in an April memorandum, pledging a proposal without a “special” tax. His bill sets up a licensing structure that places oversight in the hands of the Pennsylvania Department of Revenue, which would be responsible for implementing and administering the program.

Under the licensing framework laid out in HB 1619, distributors would pay a $50,000 license fee, operators would pay $5,000, and establishments hosting the games would pay $250. Renewal fees would be set at $25,000 for distributors, $1,000 for operators, and remain unchanged for establishments.

The legislation also hints at limitations on the number and type of skill games allowed at certain establishments, but does not specify what those limits would be, instead leaving that authority to the Department of Revenue.

“A program is established within the department to regulate the distribution, operation, and use of skill games in this Commonwealth. The program shall be implemented and administered by the department,” the bill states.

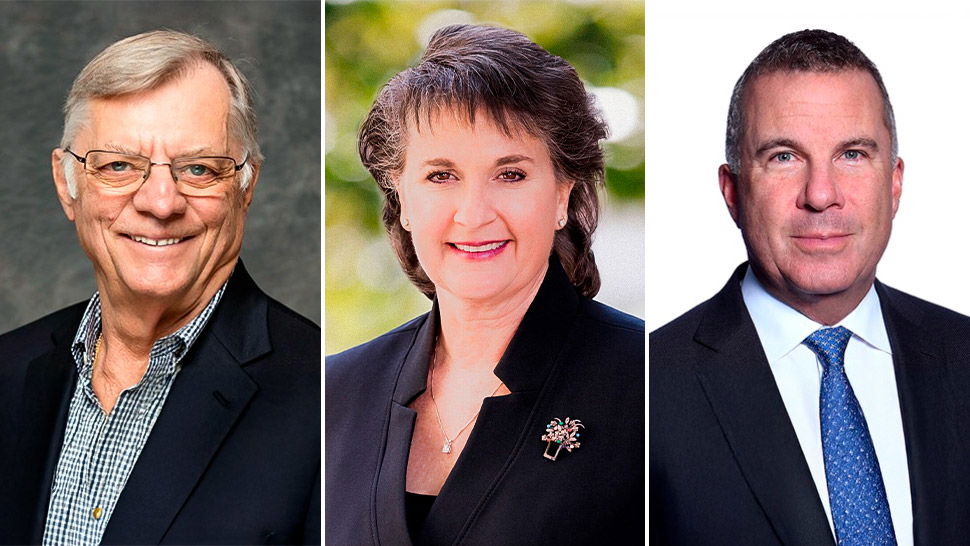

While HB 1619 steers clear of new taxes, other lawmakers have advocated sharply higher levies on the games. Governor Shapiro proposed the steepest tax rate at 52% during his 2025 budget address in February. Senator Gene Yaw introduced legislation with a 16% tax rate in April, while Senator Chris Gebhard suggested a 35% rate.

With just days remaining before the June 30 deadline for the 2025–2026 fiscal year, the General Assembly has yet to agree on a uniform approach to skill game regulation and taxation. The legislative impasse raises the likelihood that skill games will continue to operate under the legal protections granted by the Commonwealth Court’s December 2023 ruling, which confirmed their legality.