New research finds 72% rise in iGaming bonus abuse, top reported fraud for the 3rd year in a row

iovation, a TransUnion company, released Thursday its 2020 iGaming Report. Now in its fourth year, the report analyzes more than four billion global online gambling transactions iovation screened for fraud indicators over the past 15 years.

Among the findings, bonus abuse was the number one reported fraud by iovation’s iGaming customers for the third year in a row, rising 72% from 2018 to 2019. Gambling bonuses often include giving a new player house money to gamble or existing customers incentives to play more. Bonus abusers then use multiple accounts with different email addresses in order to claim the same bonus sometimes hundreds of times, which is often against gambling operators’ terms.

“Deposit bonuses can be a valuable tool for attracting and retaining players,” said Greg Pierson, TransUnion’s Senior Vice President of Business Planning and Development. “Unfortunately, a few bad apples can abuse otherwise effective programs to the point of eliminating all their value.”

Another key trend in the report was the rise in self-exclusion. iovation received over 363,000 reports of player self-exclusion in 2019, a 63% increase from 2018. The operator is now legally obligated to ensure the player does not resume gambling activities. In many instances a self-excluded gambler tries to set up a new account, many times with the information of another family member, when they have a change of heart. Or fraudsters set up a new account using a stolen credit card, deposit funds using that card and then self-exclude before the chargeback – a forced transaction reversal initiated by the cardholder’s bank.

“When looking at devices and accounts associated with self-exclusion reports in 2019, we saw eight times (three million) the number of devices and three times (1.2 million) the number of accounts in comparison to reports of self-exclusion. This paints a clear picture that those who self-exclude are not always walking away,” said Angie White, iovation Product Marketing Manager. “Having multiple devices and accounts linked to self-exclusion reports could point to a self-excluded player trying to use another device to set up a new account or something more problematic like a fraud ring.”

Other key findings in the report show that credit card fraud continues climb. iovation iGaming customers reported a 37% growth in credit card fraud from 2018 to 2019. While operators look to stop credit card fraud, consumers expect reduced transaction reviews and unnecessary step-up authentication with their credit card transactions.

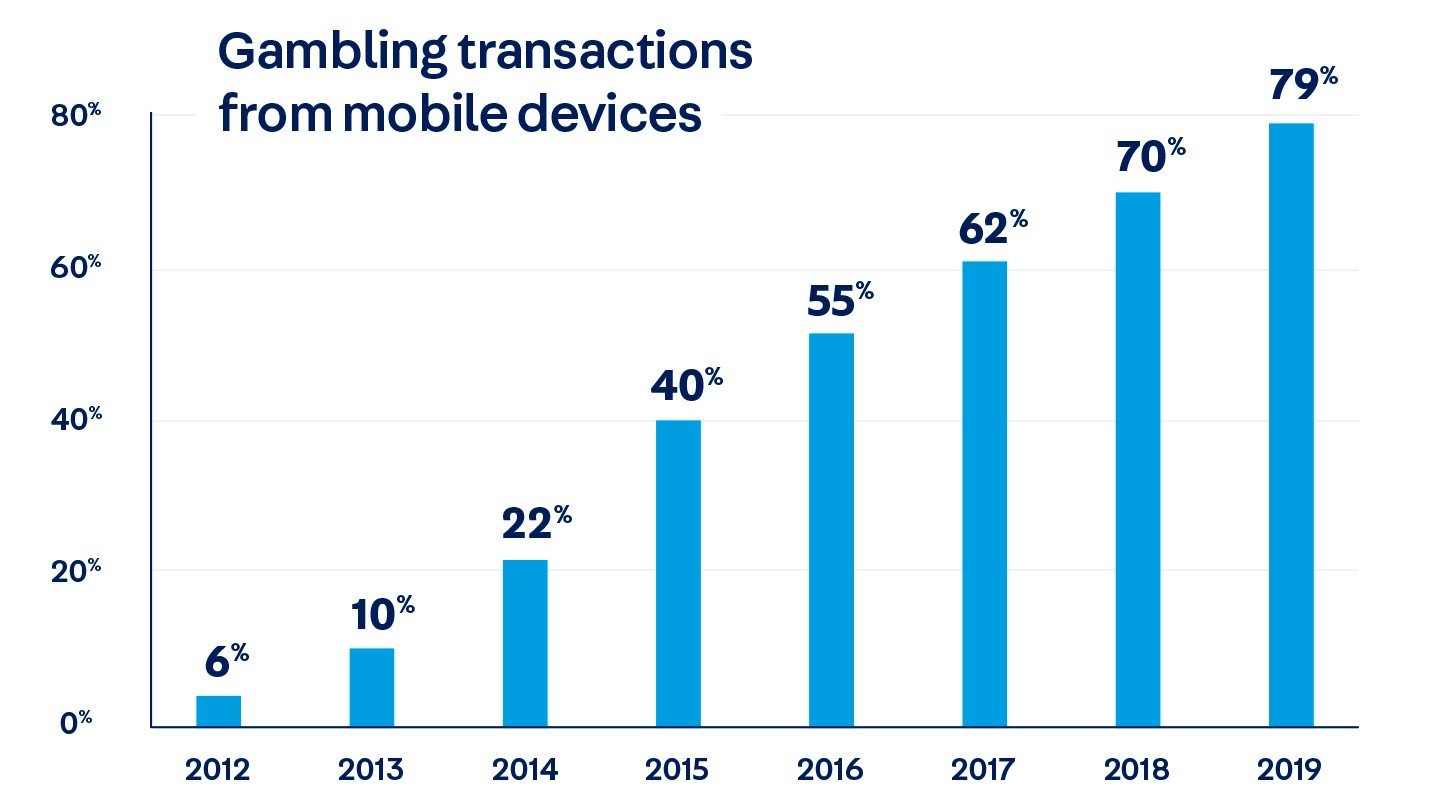

Moreover, the report shows a significant majority of transactions go mobile. 79% of all iGaming transactions came from mobile phones and tablets in 2019, an increase of 13% over 2018. It’s clear consumers expect a mobile-first experience.

“Providing a secure and friction-right mobile experience to onboard new players has never been more important for competing effectively in the iGaming market with new countries and states seemingly legalizing online gambling every week,” said Pierson.

iovation’s 2020 iGaming Report can be downloaded online. To discuss it in person, visit iovation at ICE London on February 4-6, stand N9-500. For more details about the findings, register for the Feb. 19 2020 iGaming Report webinar.