Entain lowers forecast for online profit margin amidst increased regulations, Q3 revenue drop

Gaming giant Entain, owner of the Ladbrokes, Coral, bwin, and partypoker brands, has announced a lowered online profit margin forecast for 2023 after posting a revenue drop in Q3, leading to a decrease in its share value. Online net gaming revenue (NGR) for the quarter was up 9% on a reported basis, but down 6% on a proforma basis.

This downward revision in profit margin is a reflection of the ongoing challenges faced by gambling firms, including stricter regulations and the impact of a cost-of-living crisis. In its announcement, Entain revealed that its online core profit margin for the year is expected to be approximately 25%, down from the 27.1% reported last year.

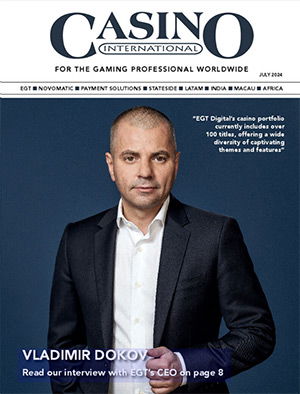

Entain's Chief Financial Officer, Rob Wood

Entain's Chief Financial Officer, Rob Wood, expressed optimism in conversation with Reuters that the regulatory headwinds would have a limited impact on the company by the second half of the coming year. The company anticipates that most of its revenue will be regulated by that time.

Entain has also set its sights on a return to growth in 2024. The operator expects that online net gaming revenue (NGR) will start growing on a pro forma basis in the next year. Specifically, they forecast low single-digit growth in online gaming revenue, with online core profit margin expected to range between 24% and 25%.

The company did face some challenges over the last two weeks, hit by customer-friendly results in the European soccer leagues. These challenges are expected to impact the core profit for the year, resulting in an approximate £45 million ($54.80 million) reduction.

Despite the adverse Q3 results, Jette Nygaard-Andersen, Entain’s CEO, remained optimistic: “Entain has undergone a profound transformation over the last few years, and now has strong foundations from which to move into its next phase of growth. We have made significant investments in responsible gambling initiatives. While these steps have impacted EBITDA, they are unquestionably the right thing to do to improve our long-term prospects."

Jette Nygaard-Andersen, Entain’s CEO

"From here, we have a clear plan to focus our portfolio for organic growth, drive our market share in the US, improve our operational leverage, and increase our EBITDA margins. The wide range of initiatives that are underway will cement our position as a customer-focused industry leader, enable us to achieve our strategic ambitions, and deliver enhanced returns for all our stakeholders.”

Entain's share value dropped to a three-year low initially in response to these announcements. However, it later recovered somewhat, trading at 1.5% down to 925 pence.

While online NGR was down 6% on a proforma basis, total group revenues, which include retail and BetMGM sales in the US, saw a 7% increase. This growth was boosted by a strong third quarter for BetMGM, its joint venture with casino giant MGM Resorts, with net gaming revenues surging by 15% compared to the previous year.

Overall, Entain is maintaining its full-year EBITDA guidance, with expectations ranging between £1 billion and £1.05 billion ($1.22 billion and $1.28 billion).