Kindred unveils ambitious $1.8 billion revenue target and strategic goals for 2025

Gambling giant Kindred Group is providing an update on the company's strategic direction, operations and financial performance. The firm is presenting a bold financial target for 2025 of revenue above £1.6 billion ($1.8 billion), an underlying EBITDA margin of 21-22%; a distribution policy of ~75-100% free cash flow (after M&A). The 2025 expected revenue figure would be 27.1% higher than its total revenue for 2021.

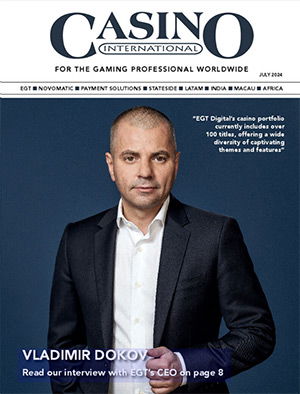

CEO Henrik Tjärnström and CFO Johan Wilsby will address the new targets at a Capital Markets Day in London. During the event, to be held today (Wednesday), the CEO and members of the management team will detail Kindred’s long-term strategic direction and priorities for the coming years.

Gaining further market share is among the first items on the company’s list, especially in existing core markets in Europe and Australia, which are expected to grow "with a CAGR of 7% between 2021 and 2026."

Developing a strong position in the Netherlands is also projected, as the market is also expected to reach new levels in the coming years, according to H2 Gambling Capital, thanks to the efficient completion of a stringent license process and local experience.

Henrik Tjärnström

Another company priority will be leveraging strategic investments, such as last year's Relax Gaming acquisition, and the development of the Kindred Sportsbook Platform, "where increased flexibility, scalability and access to product content will differentiate the company from the competition."

Finally, building on the solid market foundation established in North America as the region matures, "and focus on customer experience increases," is also among the pillars of the brand’s immediate future.

"I am delighted to share a more detailed view of our strategic direction and priorities we have set out at Kindred," said Tjärnström. "We have been a driving force in the transformation of the industry and understood early on the requirements to succeed in a locally regulated and complex environment. We now have critical building blocks in place, and I am fully confident in the direction we are taking."

"It is also very encouraging to see the progress being made in the development of our Kindred Sportsbook Platform, with key milestones already achieved, towards a selected market launch around year-end 2023," further noted the CEO.

He also commented that the entry into the Netherlands has “exceeded our expectations" and the company is well underway to reach the ambition of a 15% market share "by the end of the year."

While the $1.8B+ revenue target for 2025 is an ambitious goal, Kindred expects the revenue increase to be built on the company's focused strategy and by "utilizing the significant growth opportunities" in existing markets. Netherlands is expected to be an important contributor during the coming years, along with improved product differentiation and unique content supply.

The expected revenue growth, combined with continued cost optimization and scalability, is anticipated to support Kindred’s target to reach an Underlying EBITDA margin of 21% – 22% in three years. The total costs for Kindred’s sports betting business are expected to decrease by approximately 30% after full implementation, which is expected beyond 2025.

The company's Board of Directors has decided to revise the previous dividend policy. Kindred’s new policy is to generate "a stable ordinary dividend in absolute GBP denominated terms, paid in two equal tranches in the second and fourth quarter." In addition, Kindred will complement dividends with share buybacks.

The total pay-out of dividends and buybacks will be based on an assessment taking into account Kindred’s financial position, capital structure and future investment needs, including acquisition opportunities. The total payout ratio of dividends and buybacks should over time equal about 75% – 100% free cash flow.

The Unibet owner is also setting a target on the share of locally regulated gross winnings, with a target of around 90% in 2025. During the first half of 2022, the share reached 78% and over the coming years, it is expected to gradually increase and reach the targeted figure.

The new financial targets were unveiled after the Nasdaq Stockholm-listed group revealed a 32.2% decline in revenue during H1 2022. The worse-than-expected performance has led to rumors of company representatives exploring a potential sell of the business as of late.

However, in contrast with its poor H1 performance, Kindred said today that its performance thus far in Q3 shows "a solid gross winnings revenue development" driven by high activity across markets. While average daily gross winnings revenue for the period from July 1 to September 11 was 12% lower than Q3 2021, it was up 6% when excluding the Netherlands.