theScore readies to launch sports betting in Ontario, enter at least 4 US states

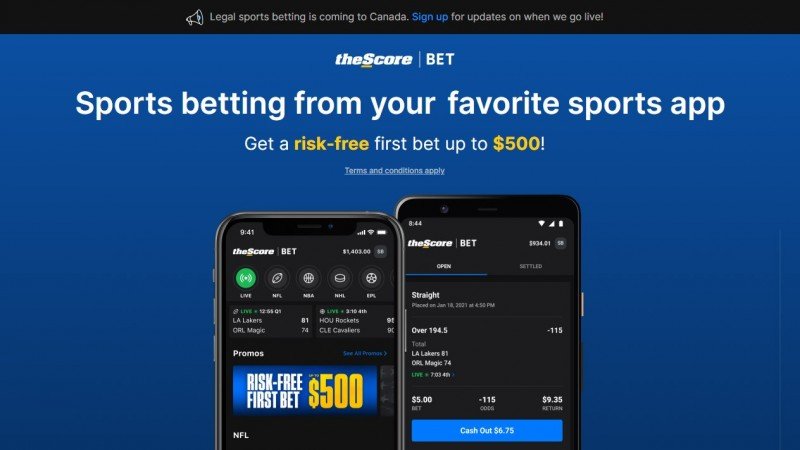

Score Media and Gaming expects to launch its app-based gambling platform in at least four new U.S. states over the next year, as the Toronto-based media and gaming company prepares to take bets from Canadian sports fans for the first time.

theScore hopes to leverage its Canadian digital sports media brand to capture a significant share of the country's long-awaited single-sports betting market.

Last month, legislation to legalize wagers on individual hockey, football, and other individual sports matches became law in Canada. Ontario, Canada’s most populous province, is expected to allow new forms of betting by the end of the year under a framework to be released by iGaming Ontario, a new government entity that will oversee online gambling in the province.

Score Media’s Chief Executive Officer John Lecy, told analysts following the release of theScore’s fiscal third-quarter (three months ended May 31) earnings on Tuesday: “With a large and passionate Canadian user base, strong brand identity, and experience operating a powerful mobile betting platform in the U.S., we are extremely well-positioned to succeed in Ontario, and across the country,” reports Yahoo! Finance Canada.

"There is an enormous potential market opportunity in our home province of Ontario, which is expected to be the largest regulated sports betting market in North America by population upon its expected opening later this year," he added.

A report earlier this year by Deloitte Canada suggests that within five years of legalization, Canadian sports betting could grow from $500 million to nearly $28 billion in legal-market wagering.

Facing competition from sports betting giants like DraftKings, FanDuel, and BetMGM, theScore has launched its app-based sports-gambling platform in New Jersey, Colorado, Indiana, and Iowa.

Macquarie analyst Chad Beynon, said: “They currently have between half a percent and one percent share in the markets that they're currently operating in.”

theScore predicted on Tuesday that it will at least double its number of markets south of the border in the next 12 months. The company said its gaming handle, or the value of bets it manages in wagers for the quarter, fell to $73 million for the three months ended May 31, down from $81.6 million in the previous period. However, the company noted a record month of bets in March driven by interest in NCAA basketball.

theScore reported $6.43 million in revenue for its third quarter, and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of negative $21.1 million. Analysts polled by Bloomberg expected revenue of $9.31 million, and an adjusted EBITDA loss of $8.99 million.