Atlantic City's iGaming jumped 51% in November

In November, revenue decreased 1.4 percent, to $191.1 million, at the city’s eight brick-and-mortar gambling halls compared with the same month last year.

But factoring in Internet gambling revenue, which was up 51.3 percent in November, the industry saw a year-over-year revenue increase of 0.9 percent last month, state regulators said Monday.

This year, through November, the entire Atlantic City casino industry — Internet and brick-and-mortar operations — brought in $2.37 billion in gambling revenue, 7.1 percent less than in 2014.

This year will mark the ninth straight year of falling gambling revenue for the industry, which saw four of 12 casinos close in 2014.

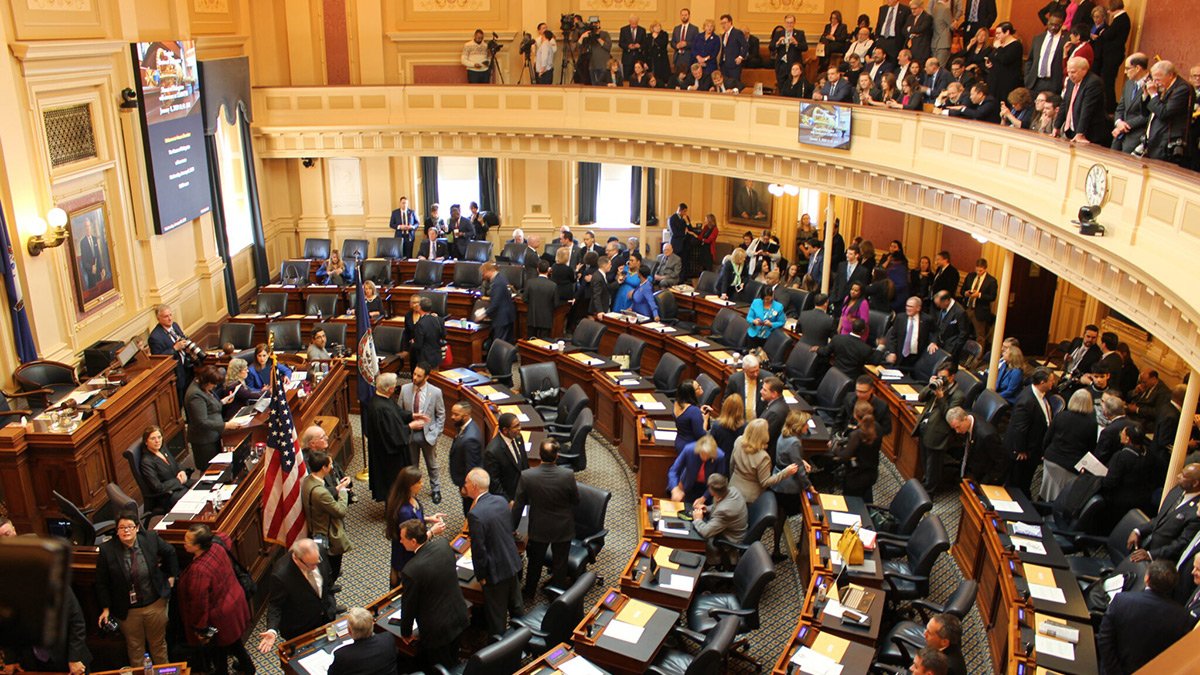

Last week, state lawmakers unveiled a plan to hold a referendum on whether New Jersey should allow as many as two casinos in the northern part of the state. The vote, if it happens in November, could result in the undoing of an intrastate casino monopoly Atlantic City has held for nearly four decades. It’s widely expected that North Jersey casinos would take a big bite out of Atlantic City’s already sliding revenue, although proponents of the plan say some revenue will be redirected downstate to at least partially offset losses.

As a whole, the eight Atlantic City casinos that survived 2014 have stabilized somewhat, bringing in 3.3 percent more revenue through November than during the same stretch last year.

Five Atlantic City casinos are up in gambling revenue through November. Borgata, the industry’s unrivaled market leader, added $49.1 million — a 7.7 percent increase from last year. Golden Nugget, a far smaller property that has been doing boffo business, added $44.6 million, up 26.3 percent. Resorts Casino Hotel, New Jersey’s first legal casino, is having a notable year also, adding $21.1 million, or 16.4 percent; that number does not include revenue from its Internet casino company, Resorts Digital. Tropicana added $14.3 million, up 5.2 percent, and Harrah’s added $12 million, up nearly 3.6 percent.

The city’s three bankrupt properties posted decreases. Trump Taj Mahal, which is waiting to be taken over by Wall Street mogul Carl Icahn, is down $35.5 million, or 17.3 percent, through November. Bally’s is down $12.5 million, or 6 percent, and its sister property, Caesars, is down $15 million, or nearly 5 percent. Those figures do not include revenue from Caesar Interactive NJ, the Internet gambling arm of Caesar’s Entertainment.

New Jersey’s fledgling legal Internet gambling industry is strengthening, though. Legal Internet casinos generated $134.8 million in revenue through November — 20.2 percent more than in the first 11 months of 2014.

PokerStars, the Internet poker giant with a rabid fanbase, recently received the blessing of the state Division of Gaming Enforcement to do business in New Jersey.

The launch of the brand, in partnership with Resorts, is expected to happen in early 2016 and add momentum to an Internet casino industry that got off to an anemic start in 2013 but has been gathering steam since.