Harrah’s swings to loss in 2Q but notes market improvements in Las Vegas

The Las Vegas-based gaming company lost us$ 274 million in the quarter vs. a profit a year earlier of us$ 2.289 billion. The 2009 quarter included special one-time gains from the early extinguishment of debt. Net revenue for the 2010 quarter was us$ 2.22 billion, off slightly from us$ 2.271 billion in the year-ago quarter.

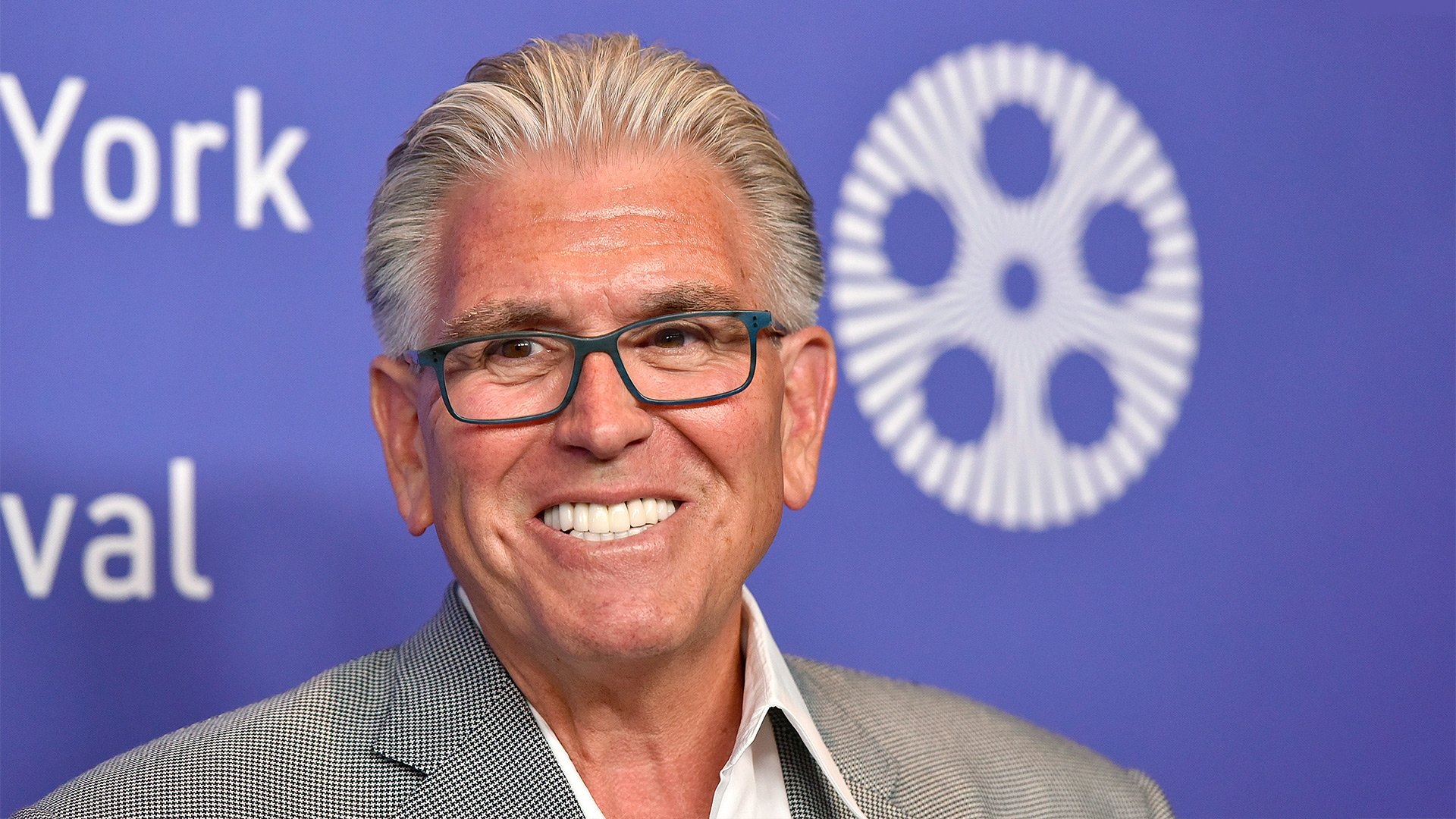

"During the second quarter, we selectively increased our marketing investments and labor costs in anticipation of an even stronger demand environment, leading to lower operating margins," Loveman said in a statement.

"However, after two years of the worst economic downturn since the Great Depression, it appears that year-over-year revenue declines are moderating in virtually all of our markets. To ensure our margins are maintained, we will remain vigilant with respect to our expense structure."

"Looking ahead, we're encouraged by the recovery of group business in Las Vegas during the second quarter and we expect group business to continue to outperform 2009 for the rest of this year," Loveman said. "We're also encouraged by the positive overall revenue trends in the second quarter and expect those to continue, as well."

The company's acquisition of Planet Hollywood boosted revenue for Harrah's on and near the Las Vegas Strip, where the company also owns Bally's Las Vegas, Bill's Gamblin' Hall & Saloon, Caesars Palace, Flamingo Las Vegas, Harrah's Las Vegas, Imperial Palace, Paris and the Rio.

Harrah's said these properties produced net revenue in the quarter of us$ 712.7 million, up 1.1 % from a year ago. Income from operations for these properties totaled us$ 72.1 million vs. a loss one year ago of us$ 123.3 million.

However, Harrah's said in today's report: "(Las Vegas Strip) same-store revenue declines of 8.2 % in the 2010 second quarter resulted from lower room rates due to increased room inventory in the market and lower spend per visitor."

Harrah's, the nation's largest hotel-casino operator by revenue in 2009, reported second quarter results elsewhere around the country for its gaming and hotel properties:

-Atlantic City net revenue fell 5.5 % to us$ 487.9 million

-Louisiana/Mississippi net revenue fell 5.1 % to us$ 298.7 million

-Iowa/Missouri net revenue fell 2.4 % to us$ 186.1 million

-Illinois/Indiana net revenue fell 5.6 % to us$ 295.5 million

-Nevada properties in Laughlin, Reno and Lake Tahoe saw net revenue fall 3.2 % to us$ 110.8 million.

Deutsche Bank analyst Andrew Zarnett, who said today's numbers missed his expectations, noted that during the quarter Harrah's announced deals with its owners Apollo Management and TPG Capital (Texas Pacific Group) and hedge fund manager Paulson & Co. in which Apollo, Paulson and TPG are exchanging us$ 1.118 billion of Harrah's debt in return for a 15.6 % equity stake.

Harrah's is raising us$ 557 million as part of the transaction by selling some debt to Apollo, Paulson and TPG and intends to use the funds to reduce other debt and fund new investments in domestic and international markets, with Zarnett saying international deals are the most likely.

"The announced debt-for-equity exchange provides us with additional liquidity to pursue growth opportunities domestically and internationally, reduce our debt and lower our interest expense," Loveman said in today's statement. "I'm particularly gratified by the confidence demonstrated by Apollo, TPG and Paulson in the performance of our company and in our prospects for the future."

"We view this event as a positive for the (Harrah's Operating) credit, given that the transaction bolsters Harrah’s liquidity over the near-term, reduces debt maturities and signals to the market that the sponsors (Apollo and TPG) are willing to sell equity at a price," Zarnett said in a research note.

Loveman also said: "I believe we're well-positioned for an eventual legalization of online gaming in the United States, and more capable of capitalizing on additional growth opportunities than at any time in the past two years."