Which will be 15% of a remote gaming provider's profits

UK to introduce remote gaming duty in September

(UK).- HM Revenue and Customs has announced that a tax will be introduced on the gaming profits of remote gaming operators next September 1, to coincide with the full implementation of the Gambling Act 2005.

2007-08-16

Reading time 19 seg

HMRC confirmed that the remote gaming duty will be 15% of a remote gaming provider's profits at the end of each accounting period. This is the difference between stakes and payments due for participating in remote gaming, less amounts that the operator has paid out as winnings during the accounting period.

Remote gaming, according to HMRC, means playing a game of chance for a prize through any kind of remote communication, for example via the internet, telephone or interactive TV.

Leave your comment

RELATED NEWS

6% increase year-over-year

Rank Group sees net gaming revenue reach $226.5M in Q3, in line with expectations

Strategic cash-outs before multiplier crashes

PopOK Gaming launches adventure crash game CrashoSaurus

Historic building currently abandoned

England: Former Hull pub receives city council approval to transform into 24-hour gambling spot

COMPANIES

For second year in a row

EGT and EGT Digital confirm presence at Amsterdam's Casino Operations Summit as platinum sponsors

Narrated by MD Stuart Hunter

Clarion Gaming releases virtual tour film ahead of ICE and iGB Affiliate 2025 relocation to Barcelona

Deal valued at approximately $962M

Aristocrat secures final regulatory approval for NeoGames acquisition

Multi-year agreement

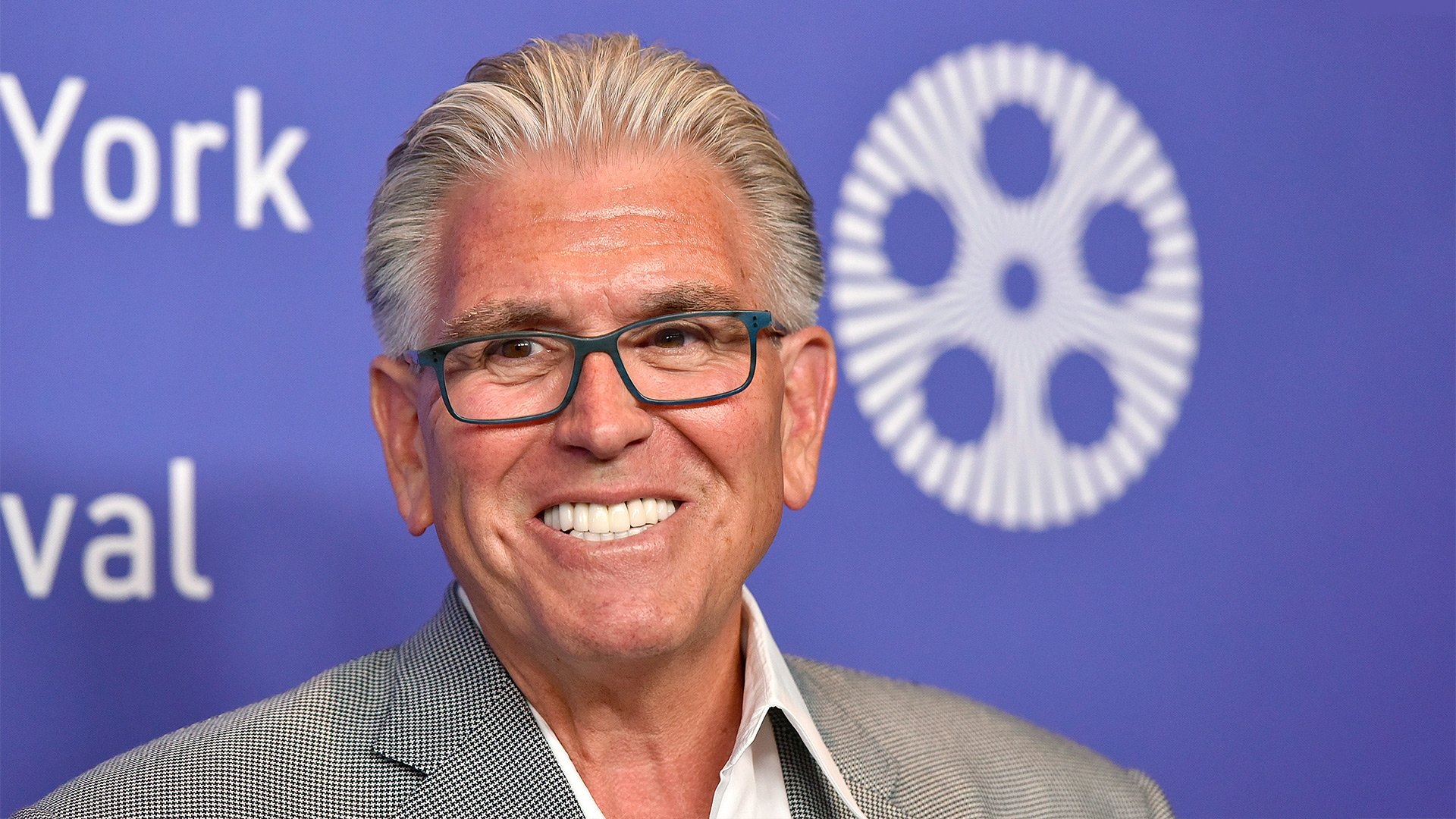

Sports broadcasting legend Mike Francesa renews exclusive BetRivers partnership

LATEST NEWS

ONLINE GAMING

LEGISLATION

SPORTS BETTING

MAGAZINES

EVENTS

Regulators and experts present

Cibelae Congress focuses on fight against match-fixing, illegal betting on first day of conferences

To take place on October 16, Poland

European Gaming Congress 2024 edition to share insights on iGaming and affiliate sector trends

Focus on emerging trends, innovation

SBC Digital Innovation – Casino event to explore key iGaming industry issues and trends on April 17

EVENTS CALENDAR

Highlighted

SBC Summit Rio 2024

Highlighted

SAGSE Latam 2024

Highlighted

Indian Gaming Tradeshow

Highlighted

GAT Expo Cartagena

APR 9th 24 / APR 11th 24

Live Event Centro de Convenciones Las Américas, Cartagena de Indias

Highlighted

DigitalPlay Summit 2024

Highlighted

IGE Italian Gaming Expo & Conference

Highlighted

BIS Brazilian iGaming Summit SiGMA Americas

Highlighted

SBC Summit North America

Highlighted

PGS 2024 Peru Gaming Show

Highlighted